The Perfect home is waiting for youLet us help you find the perfect loan to go with it.

Complete our online secure application.

View today's mortgage rates and APR's.

Get the latest in the mortgage industry.

Midwest Bankers

Mortgage Loans in Indiana

Trying to find the right home loan can be difficult. Finding the right company to help you get your loan can be even more confusing. With literally thousands of lenders to choose from, borrowers can easily become overwhelmed. Midwest Bankers specializes in serving clients who have been turned down from other lenders due to issues with credit, high DTI, or who need help getting a lower payment. In terms of purchase products, we proudly offer the following:

FHA | VA | USDA | Conventional

Refinancing? We can help you with that, too!

We offer a wide range of refinance options, designed to best meet the needs of local borrowers. If you're looking for cash out, or to just get a better rate and term, we can assist you. We offer the following Refinancing Programs:

FHA Streamline | FHA Cash Out | VA Streamline | VA Cash Out | USDA Streamline | Conventional | HARP | Jumbo

Fortunately, at Midwest Bankers, our mission is to set a high standard in the mortgage industry. We are committed to exceptional customer service - putting the people we serve first. Take advantage of our expertise in the residential lending industry by applying online today. You will find that the skill, professionalism, and consideration we give to each of our clients makes getting your loan a successful endeavor.

We are a family of trusted mortgage professionals who, through high integrity, take pride in creating lifelong relationships by dedicating ourselves to your mortgage needs. We offer the assistance you need to help in all of your mortgage endeavors. Whether you are consolidating your debt, refinancing your home, or buying your first home, we have the expertise to make it a fast, easy, and enjoyable process. Our website offers a variety of online applications options, and our experienced professionals offer superior quality support throughout the entire experience.

Give us a call today at 800-341-2084 for a free, personalized consultation. You can also apply online. It is fast, secure, and easy. Why wait? Let us go to work for you!

Recent Articles

06

2026

You’ve probably had the same checking account since you were sixteen. Your bank knows your name. Your debit card works everywhere. Loyalty feels safe. But when it comes to a mortgage, that “loyalty” can quietly turn into a convenience fee—and sometimes, a...

28

2026

When most homeowners hear the word refinance, they immediately think one thing: getting a lower interest rate. While that can certainly be part of the picture, it’s far from the whole story. In reality, refinancing is less about chasing rates and more about using your mortgage as a...

19

2026

If you’ve been waiting for the right moment to buy a home, this could be the sign you’ve been looking for. Mortgage rates have recently dropped to their lowest level in nearly three years, creating a rare window of opportunity for homebuyers. After a long stretch of higher...

12

2026

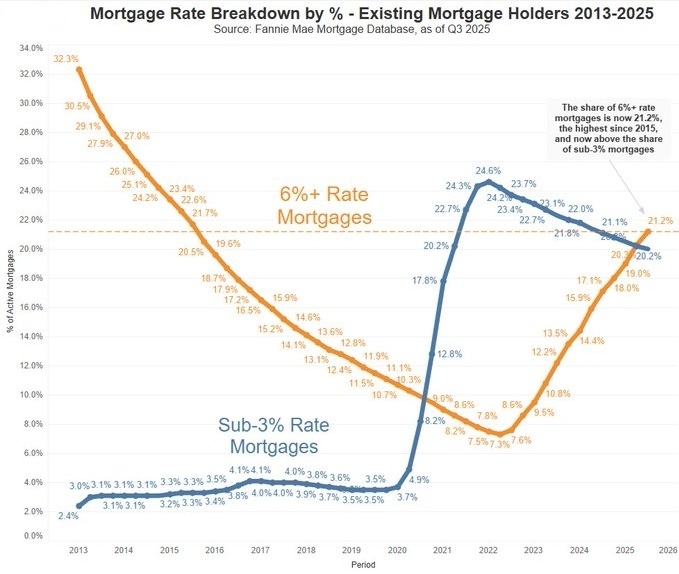

For the past few years, one phrase has dominated housing market conversations: the mortgage rate lock-in effect. Millions of homeowners secured ultra-low mortgage rates below 3% during the pandemic, creating a powerful disincentive to sell. Why give up a once-in-a-lifetime rate and...